In early December 2022, the Central Administration announced a further 1.5% reduction in base budgets for 2022-2023 on top of the 3.5% cuts already imposed on Faculty and service operational budgets earlier in the financial year 2022-2023.

For the past ten years or so, the Central Administration’s communication strategy has consistently sought to foment fear among our community about the university’s financial situation. Year after year, it publishes budget documents that portend a precarious financial reality. Then, related follow-up documents are released to ‘contextualize’ the financial results reported in the university’s audited financial statements. This is a very misleading approach.

The budget is a financial projection generated by the Central Administration without any third-party oversight. It stands in stark contrast to uOttawa’s audited financial statements whose purpose is to report third-party verified facts about our university’s financial situation. The Central Administration knowingly opts to overstate the importance of its projections and downplay both the significance and veracity of third-party verified financial results.[1]

Let’s be clear. The Central Administration is choosing to provide an inaccurate picture of uOttawa’s financial situation. The actual financial situation in which our university finds itself is far from precarious. Indeed, the misleading narrative advanced by the Central Administration is a pretext to:

- centralize financial decision-making and prioritize managerial, non-academic expenditures such as allocating more than $40M over four years for licensing, implementing, operating, and contingencies with the Workday Enterprise Management system (an amount that can reasonably be expected to have increased given this figure is based on uOttawa budget projections from 2019),[2]and spending some $51M on external consultants;[3]

- worsen our working conditions with detrimental impacts on the learning conditions of our students (e.g., ever-increasing amounts of shadow work, larger class sizes, fewer teaching assistants);

- restrict the funding of graduate studies programs, especially the financial support afforded to graduate students;

- hasten the cutting of smaller academic programs;

- avoid directing expenditures at improving the student experience by, for example, hiring more full-time regular professors and librarians, thereby reducing student-professor and student-librarian ratios;[4] and

- avoid directing expenditures toward equity measures targeted at correcting injustices, especially salary disparities.

A list of cuts to Faculties and services between 2015 and 2021 is available here.

The Central Administration’s disingenuous narrative, along with the austerity measures it seeks to impose must be contested. Both the quality of education we are able to provide and the reputation of our university are at stake.

The Supposed 2022-2023 “Crisis”

The Central Administration claims that it must impose cuts on Faculties and services because of losses in the financial markets and a deficit in uOttawa’s Operating Fund. However, its assertion does not stand up to scrutiny, and the remedy it is imposing will impede the ability of our university to meet its teaching and research missions.

uOttawa invests in a wide range of investment vehicles (e.g., Canadian and International Equities, Fixed-Income, Real Estate, Infrastructure, Hedge Funds and Public Debt). Income generated through such investments constitutes only a small portion of the university’s total income. Tuition fees and operating grants are uOttawa’s primary sources of revenues. The university’s audited financial statements show that, when averaged across the past three (3) years (2019-2022), investment generated income accounted for less than 5.2% of uOttawa’s total revenues.

Investments possess an inherent value (for example, the price of a particular stock or mutual fund). This is known as the fair value, and this value is in constant flux, changing day-by-day. Changes in fair value constitute unrealized surpluses and losses that are not realized until the investments are liquidated (e.g., selling a stock). Put simply, fluctuations in fair value do not constitute concrete gains or losses.

Canadian accounting rules mandate that universities identify in their audited financial statements the change in the fair value of their investments as per the last day of their fiscal year (April 30th for uOttawa) even when investments are not liquidated.

Why does this matter? If financial markets are higher on the day uOttawa files its financial statement than on the day it filed during the previous fiscal year, the university reports an unrealized surplus. If, on the other hand, the financial markets are lower on that day, an unrealized loss is reported.

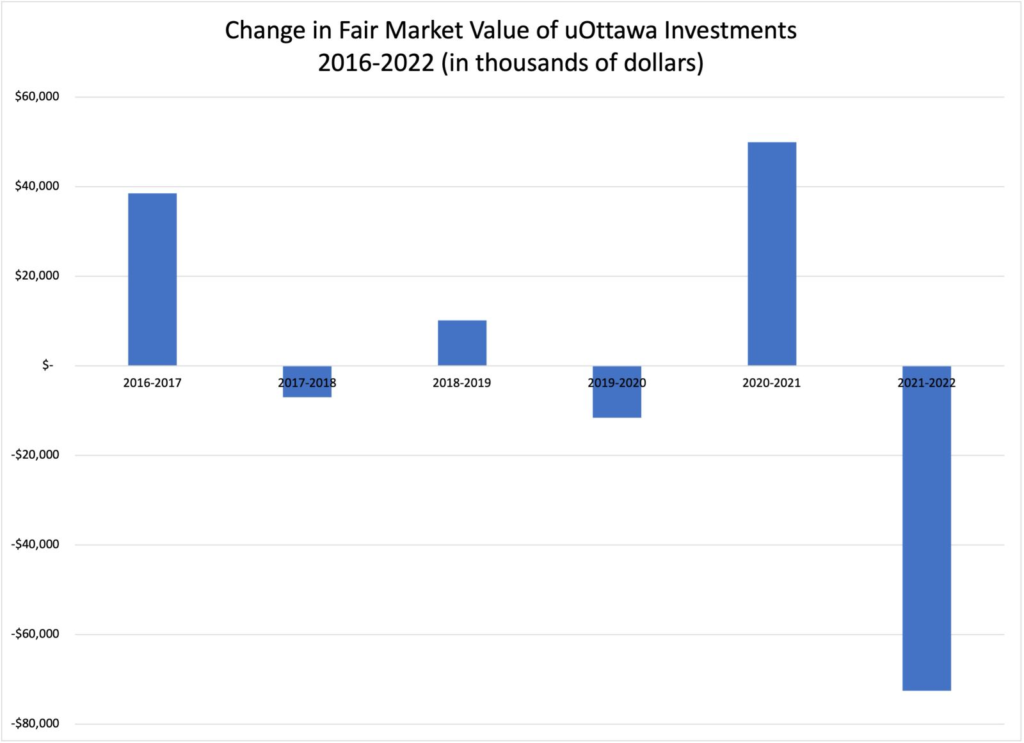

The chart below shows the changes in fair value of investments as reported in uOttawa’s audited financial statements from 2016 to 2022.

What does this chart tell us?

The Central Administration is using a single point-in-time fair value unrealized loss to justify its claim of uOttawa being in financial crisis. When one looks at the ebb and flow of financial markets (e.g., S&P/TSX Composite Index; the Dow Jones Industrial Average) over time, short-term dips in value followed by regular gains in value over the longer term is the norm. Financial markets show regular growth despite occasional shorter-term dips. As such, any conclusion drawn from the fair value at any given point in time is inherently flawed if it does not account for how dips in value are offset by regular market growth.

Bearing this in mind, the most important question is: Does uOttawa have an operating deficit?

A Closer Look: uOttawa’s Operating Fund

In addition to decreases in the fair value of uOttawa’s investments, the Central Administration has pointed to the Operating Fund being in deficit as contributing to the supposed financial crisis facing the university.

uOttawa’s Operating Fund is where the university keeps track of its day-to-day expenses and revenues. It can be used without external restrictions to achieve the University’s teaching, research, and community service objectives. This Fund is separate from the Endowment Fund (donations to the university, can only be used as specified by the donors), the Capital Fund (property, buildings, and other assets), Ancillary Services (food services, residences), and Research Restricted Funds (must be used according to restrictions imposed by external fund providers, e.g., for research projects, research chairs).

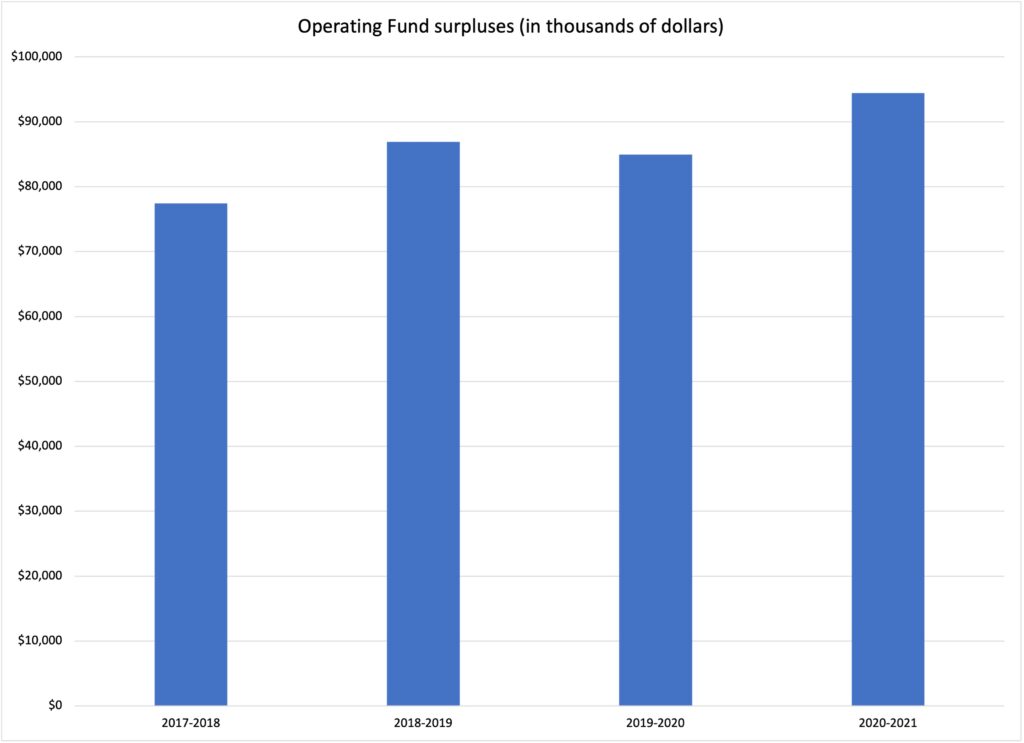

The performance of the Operating Fund provides a concrete sense of the ability of uOttawa to fund its primary objectives. This said, it is important to keep in mind that the Central Administration regularly makes transfers from the Operating Fund to the other Funds as part of its regular budgeting practices. In the past few years, the interfund transfer amount from the Operating Fund to the other Funds has varied from $18.7M in 2017-2018 to $48.4M in 2020-2021.

The chart below presents the amounts of uOttawa Operating Fund surpluses prior to interfund transfers between 2017 and 2021. As the chart makes clear, during this period the university ran very large Operating Fund surpluses. We do not have comparable data for the fiscal year 2021-2022 because in 2021 the Central Administration stopped reporting Operating Fund surpluses prior to interfund transfers.

Why does this matter?

The Central Administration’s claim of an Operating Fund deficit is being used to both foster a false sense of financial instability and justify cuts across all faculties. Yet, the Central Administration can ‘manage’ reported Operating Fund results by simply increasing or decreasing the amounts transferred between Funds. In other words, the supposed deficit is a product of reporting the Operating Fund as being in deficit after realizing the interfund transfers.

Going Forward – Every Budget Is A Choice

The unrealized losses in the fair value of uOttawa’s investments for the financial year ending April 30th, 2022, were the result of volatile financial markets that have already partly recovered. Unrealized fair value investment surpluses or deficits are temporary in nature. They cannot and should not be used to support or define the core activities of the university. Likewise, in the absence of the Central Administration using interfund transfers to manufacture deficits, the uOttawa Operating Fund continuously shows surpluses.

The Bottom Line:

The Central Administration’s claim about uOttawa confronting a financial crisis is not credible. There is no financial crisis at uOttawa, nor is there likely to be one in the foreseeable future. There clearly is, however, a crisis of governance.

Budgets are a matter of identifying priorities and allocating resources accordingly. The APUO and the other unions and student associations need the strong support and involvement of their members to resist the 2022-2023 cuts and to preserve the quality of our programs, our teaching, our research, and the student experience.

Members received this analysis in an APUO bulletin, and were polled on their thoughts regarding uOttawa’s financial situation and the union’s ongoing demands for an open, transparent, collegial, and democratic budgetary process. Members who have not received the poll can request it at apuoco@uottawa.ca.

uOttawa Review of the financial results and Financial Statements which can be found here: https://www.uottawa.ca/financial-resources/financial-planning/financial-statements

[1] See the APUO Bulletin of November 6, 2018.

[2] See, University of Ottawa (May 2019). Modernization of Finance and Human Resources Administrative Processes: Recommendations, p. 16. https://www.uottawa.ca/financial-resources/sites/www.uottawa.ca.financial-resources/files/administrative_processes_modernization_recommendations.pdf

[3] See the 2022-2023 Budget Book, p. 16.

[4] See, Report of the 2019 Listening Tour on the issue of Workload, p. 5